Amortization refers to the process of paying off debts over a particular loan term. Also, amortization is used to write off the initial cost of a loan or an asset over a period. These assets include intangible assets like:

- Artistic assets: These include photos, videos, paintings, movies, audio-recordings, etc.

- Goodwill: It is the difference between the purchase price and the amount of price which is not assigned to the assets and liabilities.

- Leasehold improvements: The leasehold improvements can amortize over the shorter of their term of the lease.

- Software developed for internal use: These costs are available for amortization as they can be useful in their entire term period.

- Patents, copyrights, taxi licenses, trademarks, etc.

- Costs to issue bonds to raise capital are intangible assets.

- Organizational costs.

Accounting Amortization

The following things are important during a journal entry:

- Identify the residual value of the asset.

- Estimate the asset’s lifespan.

- Find out the residual value of the asset.

The following is a journal entry for an intangible asset is:

| Debit | Credit | |

| Amortization expense | … | |

| Accumulated amortization | … |

If an intangible asset has no exhaustion limit, then a periodic impairment test occurs. Hence, it may result in a reduction in the book value of the asset.

For example- An individual has spent $400,000 to obtain a broadcast license, which will expire and will be put up for auction in a span of 10 years. This license is thus an intangible asset, and it should be amortized over the 10 years before its expiration date. Thus the entry each year would be:

For example- An individual has spent $400,000 to obtain a broadcast license, which will expire and will be put up for auction in a span of 10 years. This license is thus an intangible asset, and it should be amortized over the 10 years before its expiration date. Thus the entry each year would be:

| Debit | Credit | |

| Amortization expense | 40,000 | |

| Accumulated amortization | 40,000 |

Amortization can be also compared with another important method called Depreciation.

Amortization can be also compared with another important method called Depreciation.

Although amortization and depreciation are both methods to calculate the costs and value of an asset, the two terms are very different from each other.

- Amortization is a process to identify an intangible asset’s cost over its period and it does not include the physical assets. On the other hand, depreciation is the process to identify a fixed asset’s cost over its period and this fixed asset is the physical asset.

- Amortization is done on a straight-line basis, as a result of which the same payment amount is paid in the entire loan term while, depreciation is always recognized on an accelerated basis, as a result of which more depreciation is recognized during earlier periods than in the later periods.

- Amortization calculation does not include the salvage value as it only considers intangible assets, but on the other hand, depreciation, when it is calculated, includes the salvage value, as it considers tangible assets.

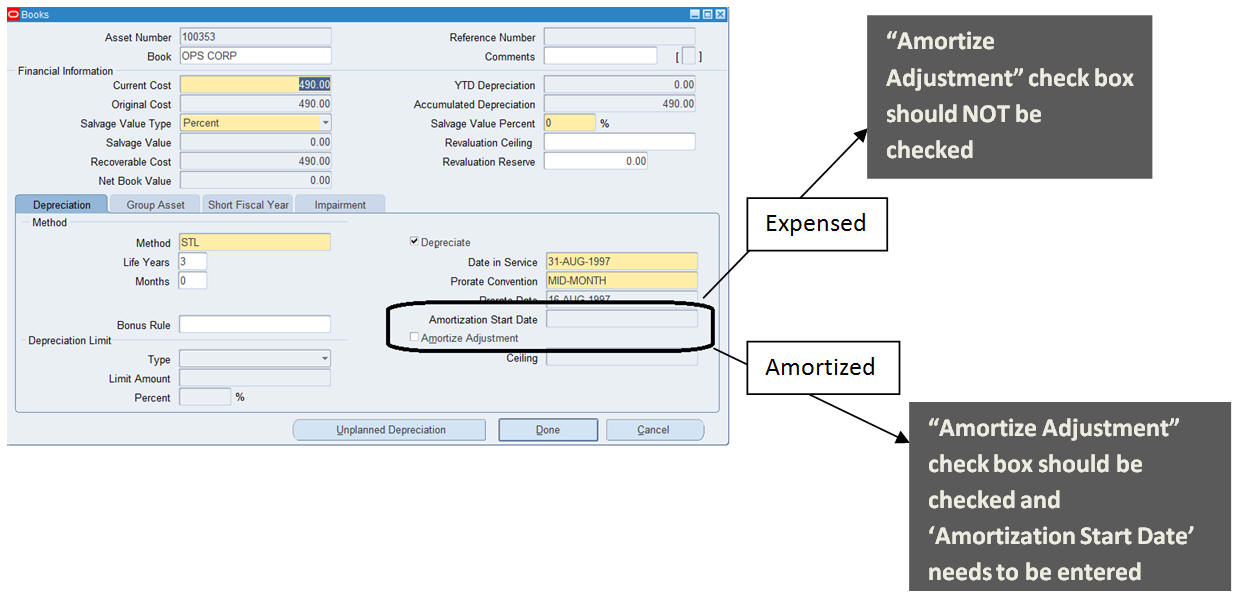

Amortized adjustments and Expensed Adjustments

The effect of the adjustment is determinable by the nature of the adjustment i.e. amortization or expenses. Oracle Assets help to simplify asset management and accounting complexities.

- When the effect of the adjustment is in the form of Data Placed In-Service (DPIS), then it is an Expensed Adjustment. The Oracle assets, in an expensed adjustment, help to calculate the depreciation amount using DPIS. Hence, it helps to identify the expected depreciation and then compare it with the existing depreciation so that any excess amount is accounted for.

- When the adjustment is not from the DPIS, but a specific period, then it is an Amortized Adjustment. The Oracle asset, in an amortized adjustment, help to spread the amount adjusted over the remaining period of the asset.

- When there is an amortized adjustment made, and expensed adjustment cannot be made on that asset again.

- Performing an amortized adjustment and expensed adjustment:

For example:

An asset which is having a cost of 24000, the DPIS of which is- 01-JAN-2017 and the depreciation method and the period is STL for 12 months and in the August-17 period, the life is changed to 15 months.

Amortized Adjustment

12 months asset life depreciation, would be 24000 / 12 = 2000 per month.

The depreciation reserve amount till Aug-17 is 2000*7 months = 14000.

So, the asset’s net book value as of Aug-17 is 24000 – 14000 = 10000.

The remaining life of the asset as of the Aug-17 period is Total life – life already completed = 15 months – 7 months = 8 months.

From the Aug-17 period onwards, the monthly depreciation for the asset will be Net Book Value / Remaining Life = 10000 / 8 months = 1250.

Expensed Adjustment

12 months asset life depreciation, would be 24000 / 12 = 2000 per month.

15 months asset life depreciation value would be 24000 / 15 = 1600 per month.

Until the Aug-17 period, the asset was depreciating on the basis of 12 months. The asset’s existing depreciation reserve value is 2000 * 7 months = 14000.

Based on the new life, the accumulated depreciation should be 1600 * 7 months = 11200.

The depreciation catch-up in Aug-17 is 14000 – 11200 = (2800).

Aug-17 onwards, the monthly depreciation for the asset will 1600.

Apart from these, there are other important aspects of amortization, which are the amortized bonds.

Furthermore, the bond with the face value or the principal amount which is paid regularly over the period is called an amortized bond. This bond’s principal amount is divisible according to the amortized schedule and is then payable in one-month increments.

Furthermore, the bond with the face value or the principal amount which is paid regularly over the period is called an amortized bond. This bond’s principal amount is divisible according to the amortized schedule and is then payable in one-month increments.

The following are the benefits of Amortized Bonds

- A bond is an intangible asset that has a limited period. Thus amortizing a bond is beneficial as it can later cut down the bond’s cost value when it almost reaches its exhausted limit.

- Amortizing a bond helps the entity issuing the bond, to document the bond discount for the entire bond’s life.

- Amortized bonds also help the issuer of the bond during tax filings.

For example-

30-year fixed-rate mortgages are amortized so that each monthly payment goes towards interest and principal. If an individual purchases a home with a $400,000 30-year fixed-rate mortgage with a 5% interest rate. The monthly payment is $2,147.29, or $25,767.48 per year. By the end of year one, 12 payments have been made by the individual, the majority of which were interest payments, and only $3,406 of the primary value is paid off, keeping a loan balance of $396,593. Next year, the monthly charge remains the same, but the major payment increases to $6,075. Next, in the year 2029, the value would increase to $24,566 (almost all of the $25,767.48 annual payments) contributing towards the principal.

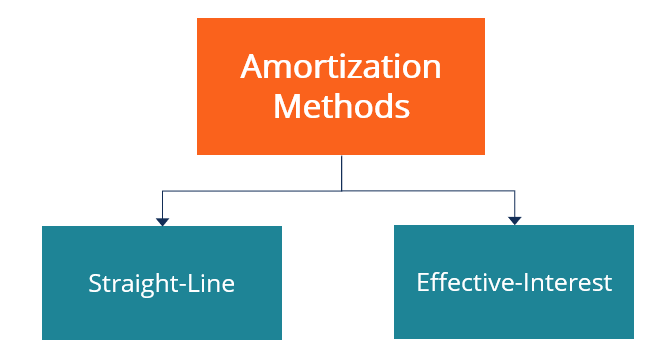

There are two methods for Amortizing Bonds

- Straight-Line method- In this method, the bond discount is equal throughout the entire term of the bond.

- Effective-Interest method- In this method, the different amortized amounts are applicable to the interest expenditure in every period.